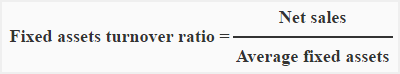

The fixed asset balance is used net of accumulated depreciation. This efficiency ratio compares net sales (income statement) to fixed assets (balance sheet) and measures a company’s ability to generate net sales from property, plant, and equipment (PP&E). The fixed asset turnover ratio (FAT) is, in general, used by analysts to measure operating performance. While the asset turnover ratio considers average total assets in the denominator, the fixed asset turnover ratio looks at only fixed assets. In these cases, the analyst can use specific ratios, such as the fixed-asset turnover ratio or the working capital ratio to calculate the efficiency of these asset classes. Sometimes, investors and analysts are more interested in measuring how quickly a company turns its fixed assets or current assets into sales. Conversely, if a company has a low asset turnover ratio, it indicates it is not efficiently using its assets to generate sales. The higher the asset turnover ratio, the more efficient a company is at generating revenue from its assets. The goal of owning the assets is to generate revenue that ultimately results in cash flow and profit. This ratio looks at the value of most of a company’s assets and how well they are leveraged to produce sales. Sales of $994,000 divided by average total assets of $1,894,000 comes to 52.5%. In this case, we’ll reduce total assets by long-term investments. Subcategory, Property, plant and equipment: You can also check out our debt to asset ratio calculator and total asset turnover calculator to understand more on business efficiency.For the Years Ended Decemand 2018 Description A company may still be unprofitable with the efficient use of fixed assets due to other reasons, such as competition and high variable costs. Hence, the best way to assess this metric is to compare it to the industry mean.Īlso, a high fixed asset turnover does not necessarily mean that a company is profitable. For example, a cyclical company can have a low fixed asset turnover during its quiet season but a high one in its peak season. As different industries have different mechanics and dynamics, they all have a different good fixed asset turnover ratio. However, no one rule defines what a good fixed asset turnover ratio is. This is because a high fixed asset turnover indicates that the company is effective and efficient in utilizing its fixed assets or PP&E. We generally assume that the higher the fixed asset turnover ratio, the better.

Fixed asset turnover ratio high or low how to#

Hence, the fixed asset turnover for Company Alpha is $7,500,000 / $16,500,000 = 0.45x.Īfter understanding the fixed asset turnover ratio formula, we need to know how to interpret the results. The final step is to calculate the fixed asset turnover with the fixed asset turnover formula:įixed asset turnover = revenue / average fixed assets Of course, you can also access this information from some financial data sites, such as Bloomberg and Financial Times.

Check our revenue Calculator and sales calculator to understand more on this topic.

You can find the income statement in every company's annual report. The revenue is always the first line item on a company's income statement. The average fixed assets can be calculated using the formula below:Īverage fixed assets = (starting fixed assets + final fixed assets) / 2įor our example, the average fixed assets is equal to ($15,000,000 + $18,000,000) / 2 = $16,500,000.ĭetermining the revenue of a company is straightforward. Assuming you have bought a stock of Company Alpha with the following information:Ĭalculating the fixed asset turnover ratio requires only 3 steps: Let's talk about how the fixed asset turnover formula works using an example.

0 kommentar(er)

0 kommentar(er)